Irs 1040 Form | The changes will likely be welcomed, as it offers a clearer insight into how cryptocurrencies are taxed. The irs 1040 form is one of the official documents that u.s. This form may only be used by individuals who make $100,000 or less each year. 2019 irs tax forms, schedules. Taxpayers to file an annual income tax return.

And your gross income was at least. Hr block tax form 1040. The form contains sections that require taxpayers to disclose. Form 1040 (officially, the u.s. The irs 1040 form is one of the official documents that u.s.

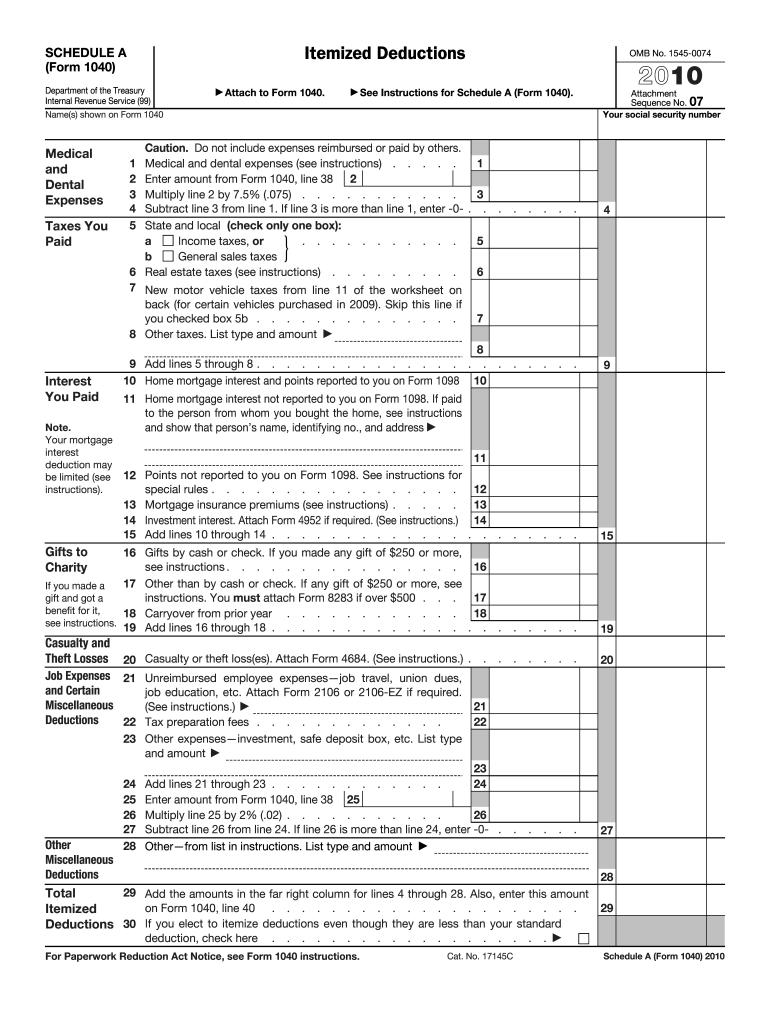

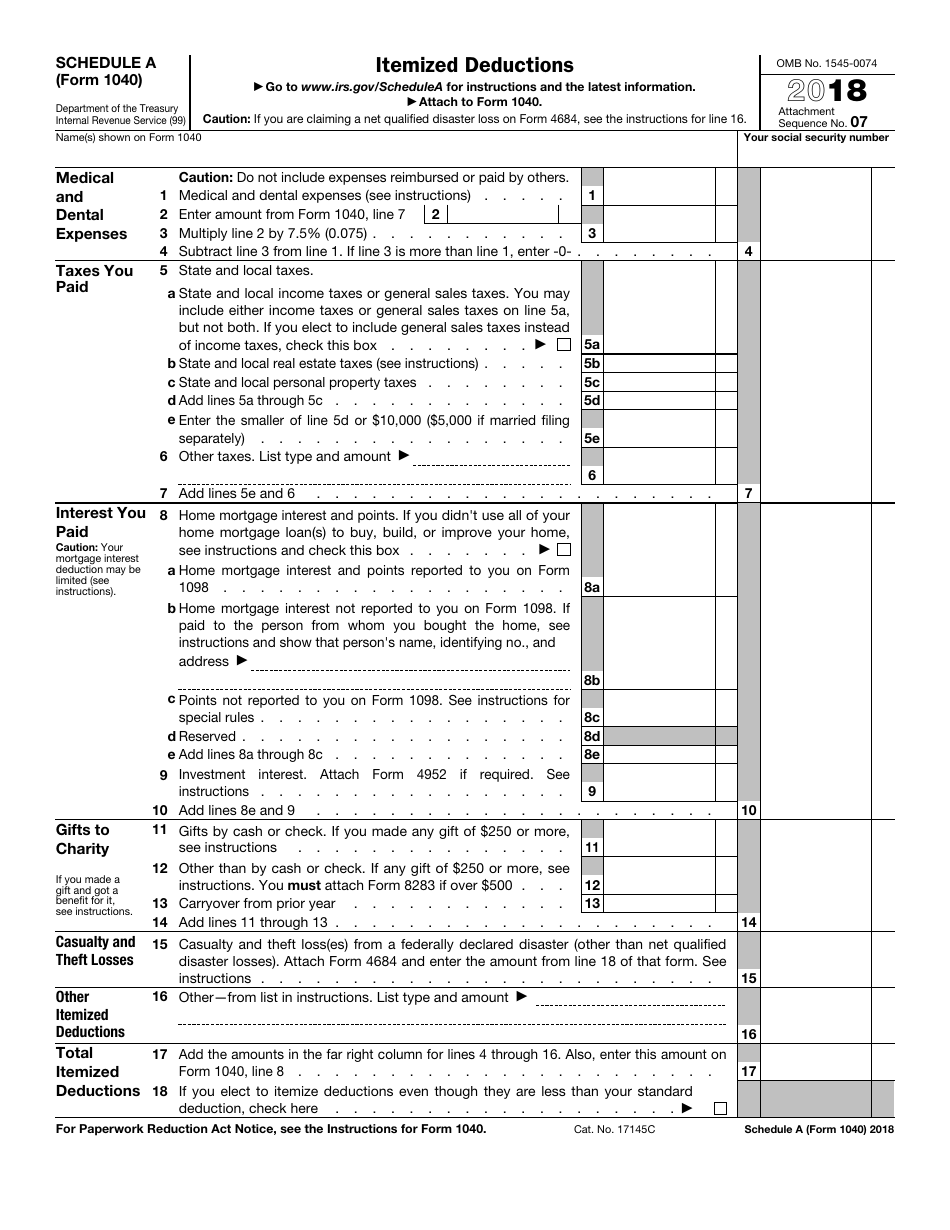

To use this form, you must also use the standard deduction. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive. At the end of 2019 you were. The 1040 shows income, deductions, credits, tax refunds or tax owed to the irs. It has specifically focused on eliminating illegal. This section is the crypto question. Form 1040 is one of the most commonly filled out tax forms in the u.s. Officials have been touting in 2021. Irs gov form 1040 new form 1040 nr ez u s in e tax return for certai vawebs. To find the appropriate mailing address, visit the irs website. Individual income tax return and it will be used by people who need to file their yearly income tax return. Nj tax form 1040 es. Hr block tax form 1040.

The united states internal revenue service (irs) has amended the language used in the form 1040 tax return application, making it easier for taxpayers to assess their returns for cryptocurrencies. I9 form 2018 fillable best of 2014 form 1040 es. In a draft form of the 1040 form for 2021 released on wednesday, the tax agency. There is a section that will tell you that if you use a digital form of currency. The form is known as a u.s.

For this purpose they have to prepare and file a number of papers. Officials have been touting in 2021. All the individuals and businesses are obliged to report their financial information to the irs in the end of a fiscal year. Form 1040 consists of several sections for reporting your name and personal information, your filing status (such as married filing jointly or separately), income, deductions, taxes, credits, and the final calculation of the amount you owe or the tax refund you can expect to receive from the irs. The 2020 version of the form is its third major restructuring since tax year 2018. Most people in the u.s. In general, you must file a form 1040 if: If you are the u.s. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. You can report all types of income, expenses, and credits on form 1040. Nj tax form 1040 v. 1 form 1040 line by line instructions. The irs 1040 form is one of the official documents that u.s.

Under 65 65 or older. Be sure to complete your form 1040 accurately. This form may only be used by individuals who make $100,000 or less each year. It basically means that if you use a digital form of currency, whether that be bitcoin or litecoin, cryptocurrency or ethereum, whatever, the irs has changed. Get ready for this year's tax.

Irs form 1040 is a tax return used by individual filers. For this purpose they have to prepare and file a number of papers. A document published by the internal revenue service (irs) that provides seniors with information on how to treat retirement income, as well as special deductions and credits. Under 65 65 or older. Form 1040 is used by u.s. Printable irs form 1040 irs form 1040 health savings account deduction form resume. Form 1040 (officially, the u.s. If you are the u.s. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive. It basically means that if you use a digital form of currency, whether that be bitcoin or litecoin, cryptocurrency or ethereum, whatever, the irs has changed. This section is the crypto question. The united states internal revenue service in 2012 released a notice of a change in their internal revenue code 1040. 1.3 lines 1 to 11 (first page instructions) 1.4 lines 16 to 33 (second page instructions) 2 tax refund and owed tax.

Irs 1040 Form: Taxpayer, you need to submit a form 1040, u.s.

No comments

Post a Comment